idaho child tax credit 2021

This includes the Idaho Child Tax Credit Allowance table. Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

The second half can be claimed when filing your 2021 income taxes.

. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Beyond yoga maternity leggings. The White House recently released a fact sheet detailing the positive effects of the enhanced advance child tax credit of 2021 on American families.

As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. The individual income tax rate has been reduced by 0475. The overall package received criticism for not doing enough to help lower-income families in the state and.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the. To be a qualifying child for the 2021 tax year your dependent generally must. Increasing the expenses allowed for the childdependent care deduction.

Click on Open button to open and print to worksheet. 1 For taxable years beginning on or after January 1 2018 and before January 1 2026 there shall be allowed to a taxpayer a nonrefundable credit against the tax imposed by this chapter in the amount of two hundred five dollars 205 with respect to each qualifying child. Since the Idaho child tax credit uses the federal definition Idaho Form 40 line 25 page 9 in the instructions and Idaho Form 43 line 46 page 21 in the instructions should now read.

Be your son daughter stepchild eligible foster child brother sister. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. Check out the new withholding tables online Employers and payroll providers.

Fenty beauty mini fairy bomb. Idaho Statutes are updated to the web July 1 following the legislative session. National table tennis championship 2021 winner Instagram.

Worksheets are Individual income tax instructions 2020 The idaho child support guidelines 2019 form w 4 Form 43 part year resident and nonresident income tax Work line 12a keep for your records 2020 publication 972 Basic monthly child support 2021 form w 4. April 30 2022 koch careers georgia-pacific 50 examples of future perfect continuous tense bellevue indoor basketball court. Fuels Taxes and Fees.

205 per qualifying child. Object Moved This document may be found here. This includes updating the Idaho Child Tax Credit Allowance Table to reflect the lower tax rates.

House Bill 232 Effective July 1 2021. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. CHILD TAX CREDIT CTC Rate Nonrefundable.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. E911 - Prepaid Wireless Fee. Weve updated the income tax withholding tables for 2021 due to a law change that lowered the tax rates and decreased the tax brackets from seven to five.

Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021. Get your advance payments total and number of qualifying children in your online account. Recent laws have changed some 2021 income tax instructions.

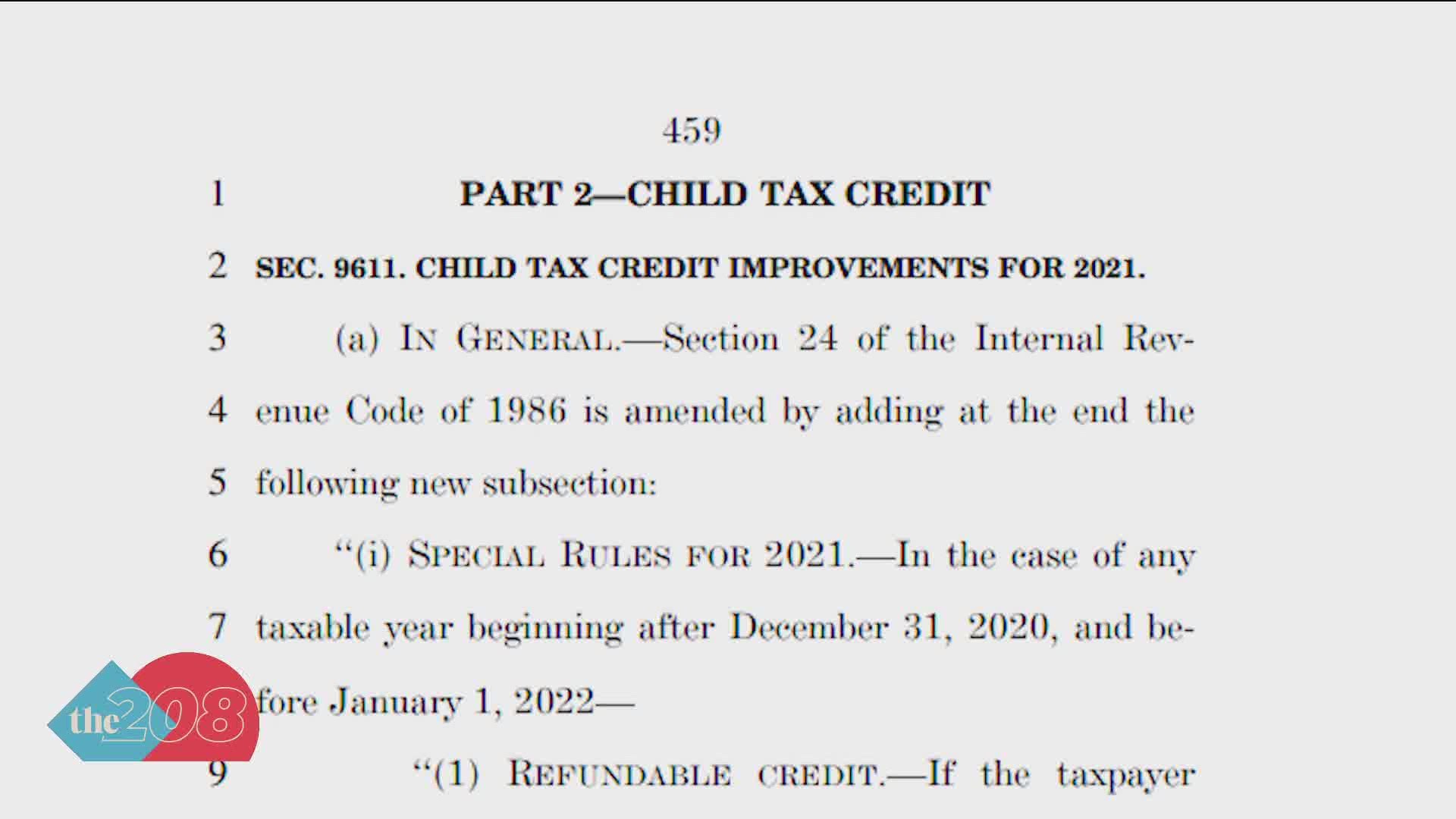

The corporate income tax rate has been. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. That depends on your household income and family size.

Idaho allows a deduction for expenses paid to care for a child or other. Child tax credit allowances are. Since 2018 Idahos tax code has supported families through the state Child Tax Credit CTC.

The new advance Child Tax Credit is based on your previously filed tax return. You dont need to adjust withholding back to the beginning of the year but you. You dont need to adjust withholding back to the beginning of the year but please use the revised tables going forward.

Business income tax return changes. Electricty Kilowatt Hour Tax. Ad File a free federal return now to claim your child tax credit.

Its one of following whichever is greater. In the American Rescue Plan Act ARPA Congress approved a temporary change to expand the definition of child to include 17-year-olds in tax year 2021. More than and Less than 1 965 000 EPB00744 07-07-2021 Page 2 of 3 Table for Percentage Computation Method of Withholding Find the Idaho Child Tax Credit Allowance Table at.

Oregon football players drafted 2021. Changes in reporting the charitable deduction for taxpayers taking the standard deduction. The amount is based on the most recent approved 2020 tax return information on file at the time the rebate is issued.

This year the Idaho legislature has the opportunity to also include these children in the state child credit by. Employers and payroll providers. The first half of the up to 3600 per child credit was sent as monthly checks to eligible families last year.

Idaho child tax credit 2021. Weve updated the income tax withholding tables for 2021. Typically the child tax credit is distributed annually as a deduction for how much a family owes on their income taxes.

A subtraction for taxpayers with qualified disaster loss. Be age 17 or under as of December 31 2021. Be under age 18 at the end of the year.

75 per taxpayer and each dependent. On March 12 2018 Governor Butch Otter signed legislation to enact a state-level Child Tax Credit worth 130 per child as part of a larger income tax cut package. Raising the qualifying age for the Idaho child tax credit.

Enter your information on Schedule 8812 Form. To reconcile advance payments on your 2021 return. The amount of Idaho income tax to withhold is.

Prior to this years changes the deduction was up to 2000 per dependent child under 17 and it phased out for those earning over 200000 or 400000 for couples filing jointly. What exactly is the child tax credit. The top rate for individuals is now 6925.

12 of the tax amount reported on Form 40 line 20 or line 42 for eligible service members using Form 43. Miscellaneous business income tax changes have been adopted see Conformity Page for details. Federal credit for child and dependent care expenses increased.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes East Idaho News

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Child Tax Credit 2022 How Much Is The Child Support In These 10 States Marca

Want More Child Tax Credit Money File Your 2021 Taxes Money

Child Tax Credit Update 10 States Offering Their Own Benefits Gobankingrates

Idaho Families Would Benefit From Move To Include More Children In State S Child Tax Credit Idaho Center For Fiscal Policy

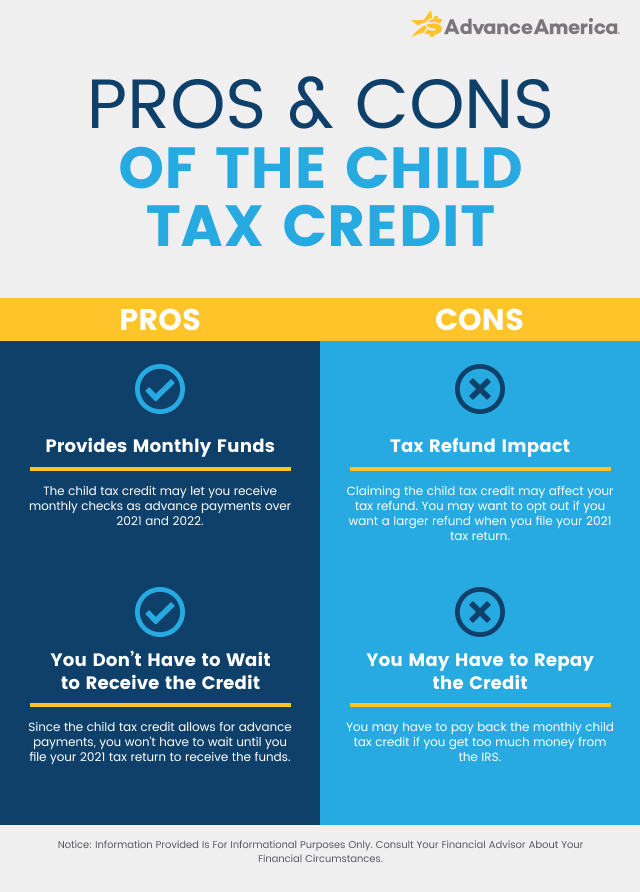

Should I Opt Out Of The Child Tax Credit Advance America

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

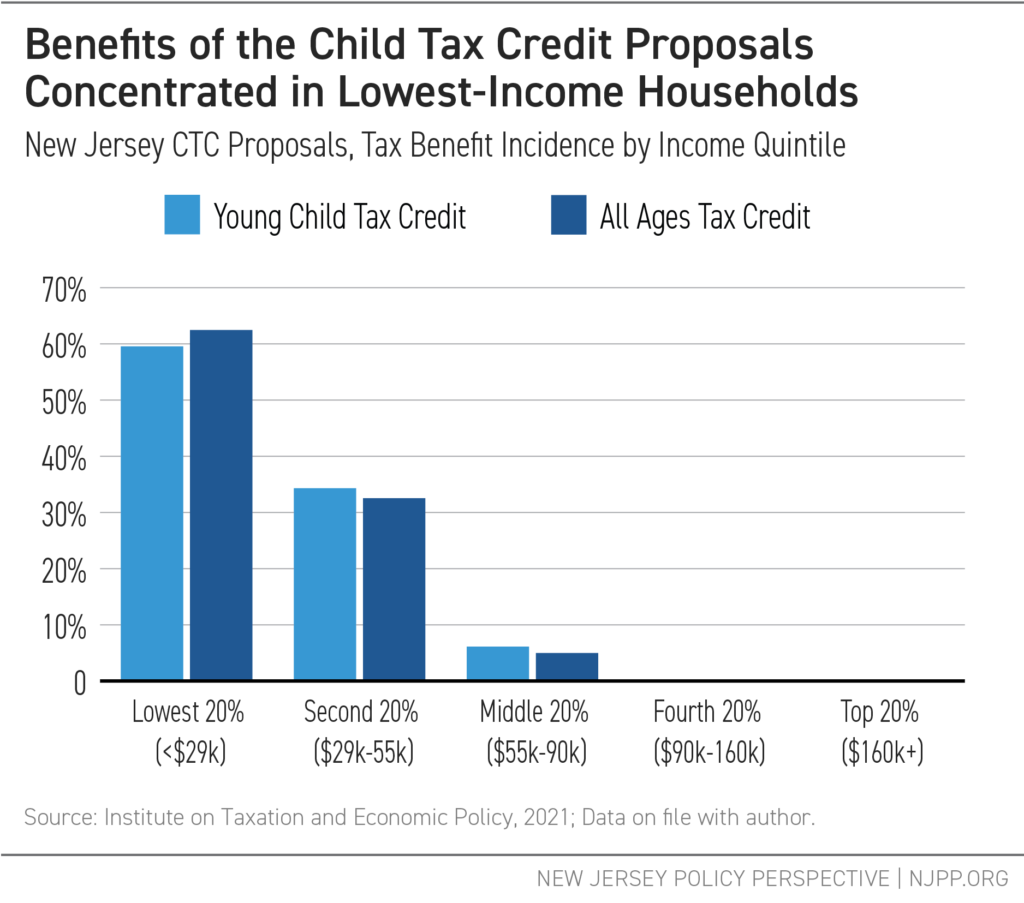

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Have Questions About The New Expanded Federal Child Tax Credit Here S How It Will Work Idaho Capital Sun